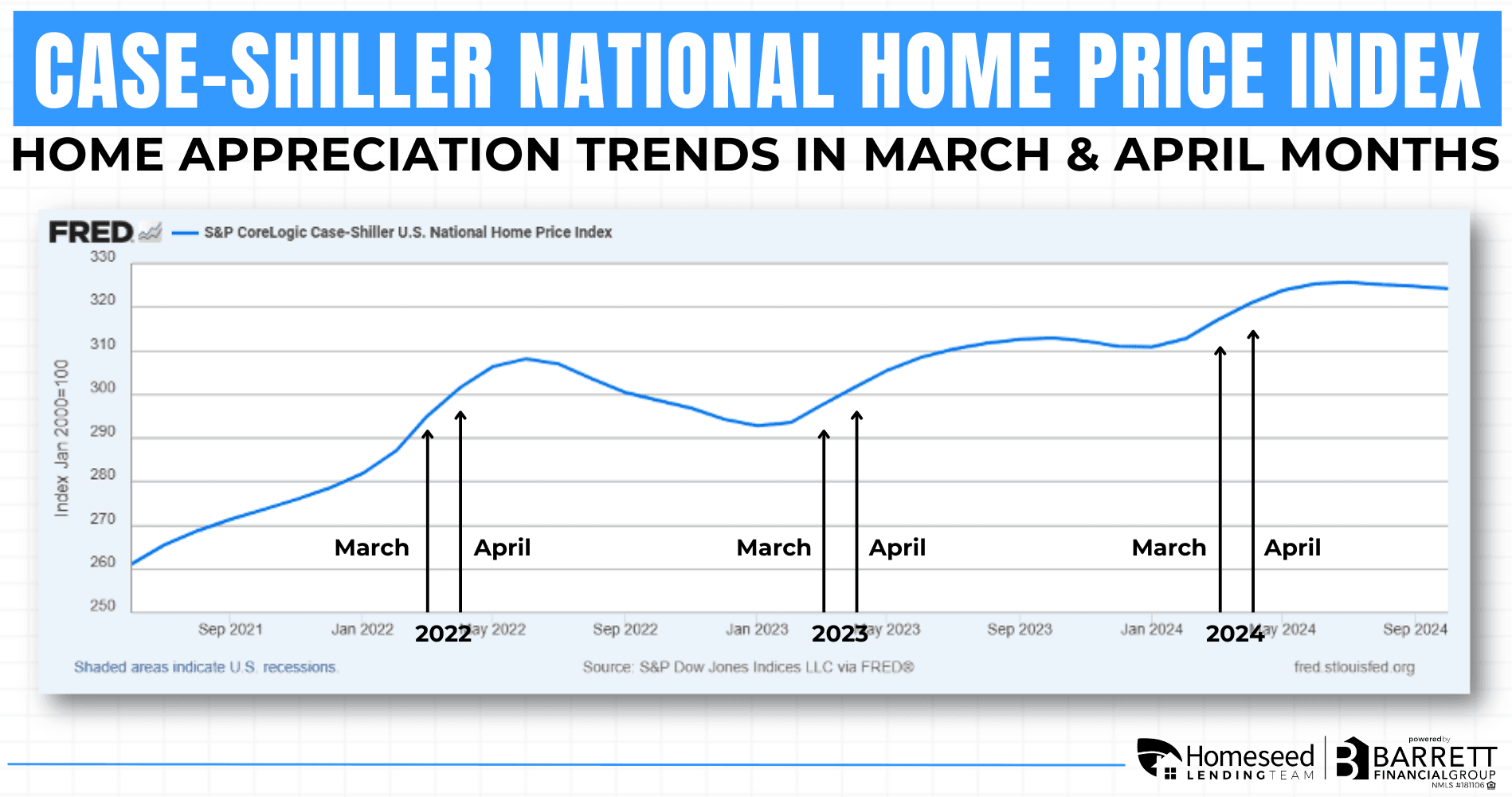

Seasonal Home Appreciation Trends Are Taking Shape

The latest data from the Case-Shiller Home Price Index confirms a pattern we’ve seen for years: home prices tend to start appreciating in March and April as buyer demand heats up with the spring market.

This seasonal uptick is driven by:

For buyers, this means that acting early in the season could help you get ahead of rising home prices. If you lock in a purchase now, you not only avoid future price increases, you also start building equity sooner.

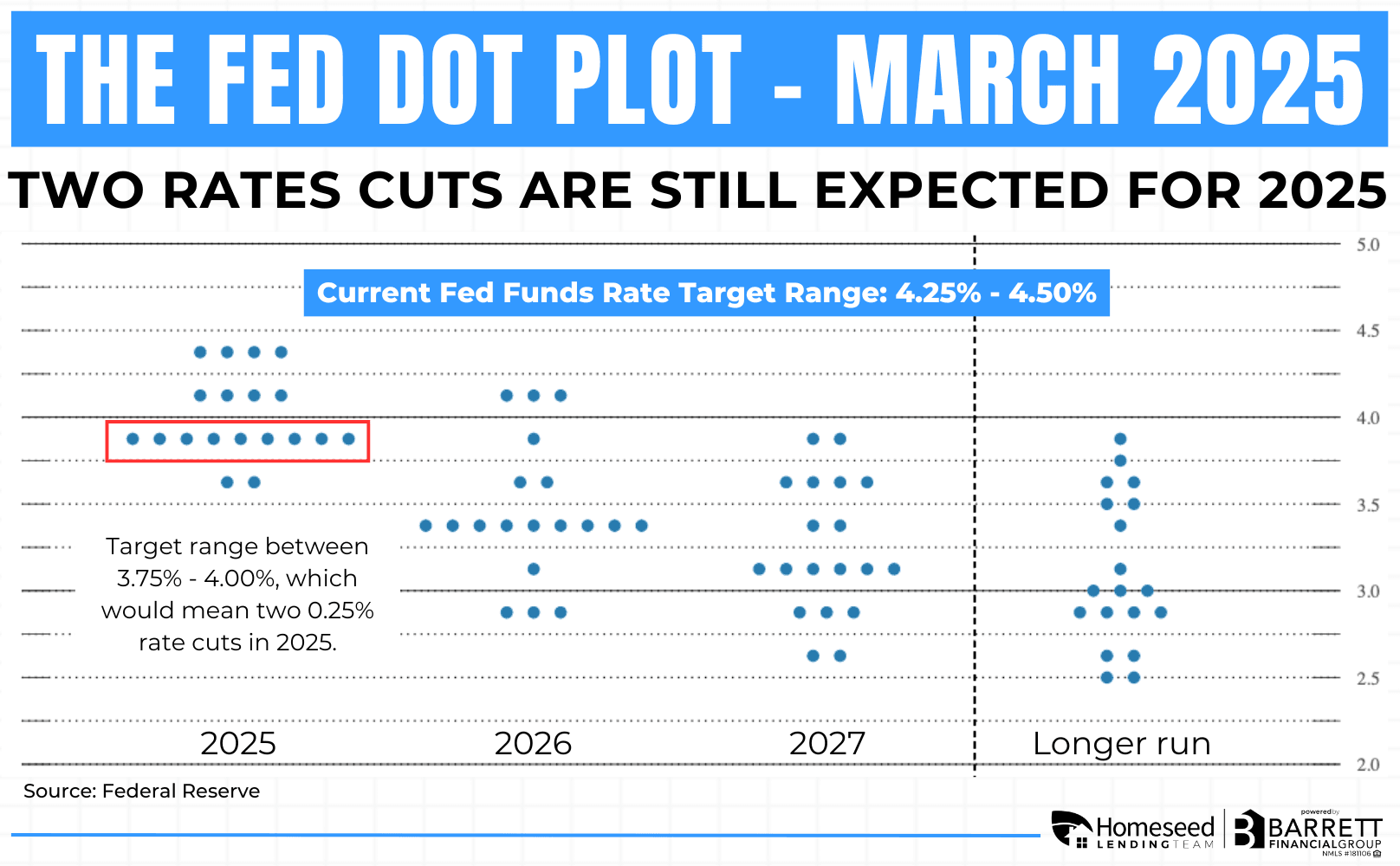

The Fed’s Next Move

As expected, the Fed kept its benchmark interest rate unchanged. However, the bigger focus was on the release of the Fed’s updated economic projections, commonly known as the “dot plot.” This visual summary shows where individual members of the Federal Open Market Committee expect interest rates to head in the future. The latest dot plot still reflects the Fed’s intention to make two rate cuts in 2025, although officials noted that the broader economic outlook has become more uncertain. The Fed is also reducing the pace of its balance sheet runoff, which could help keep long-term rates, like mortgages, lower.

Fed updates on economic outlook:

Why does this matter? Because mortgage rates typically follow market expectations around Fed policy, not just the current rate but also where rates are projected to go next. If the Fed continues to signal upcoming rate cuts and inflation continues to ease, mortgage rates could trend lower through the end of the year.

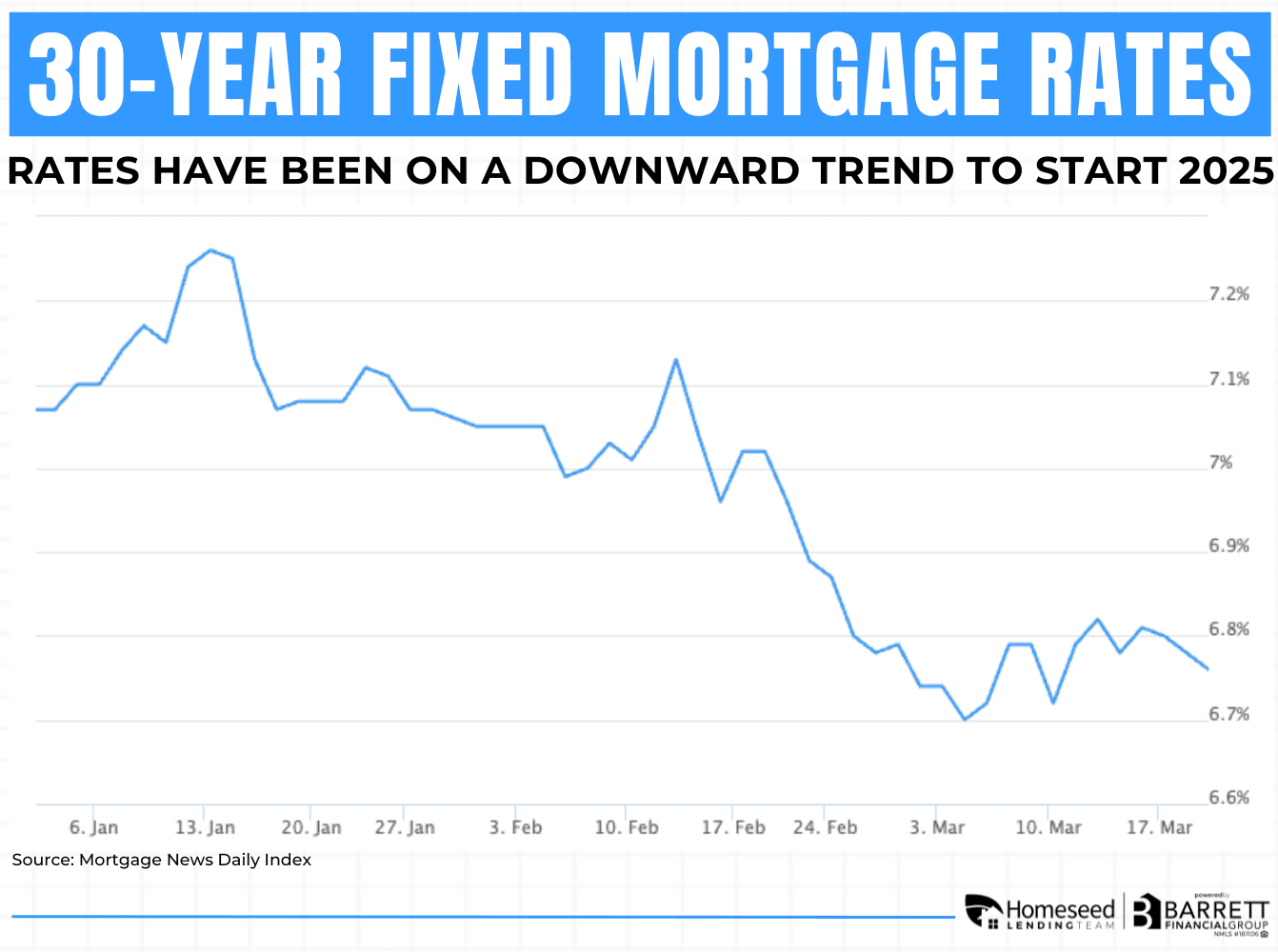

What Happens If Rates Keep Trending Lower?

Over the past two months, we’ve seen mortgage rates steadily decline, which has brought more buyers back into the market. Today’s Fed update reinforces the idea that lower rates are likely coming later this year and we could see a renewed surge in demand, which would lead to more competition as the spring market unfolds.

Here’s how that could play out:

If you’re a buyer, getting ahead of this curve could make all the difference.

Final Thoughts: Timing Matters, But Strategy Wins

While historical trends show that springtime can be a great opportunity to capture early appreciation, the reality is that there’s no perfect moment to jump in. The most successful buyers aren’t trying to outguess the market, instead they’re making confident moves based on a solid plan.

As Realtor.com’s Chief Economist, Danielle Hale, recently shared:

“There are always reasons to be uncertain in the housing market. My advice…is to keep your eyes open and when you see the home that is a good fit, go for it.”

So yes, there’s value in acting early before appreciation accelerates and competition rises, but ultimately, the right time is when you’re financially and strategically ready to make a move that supports your long-term goals.

Connect with us today to develop your strategy towards becoming a homeowner!

Loan Originator

Barrett Financial Group, L.L.C. | NMLS: 2428188