Recent Articles

Why The Homeseed Lending Team (Mortgage Broker) Saves You Money and Is a Smarter Choice

When you're shopping for a home loan, you have options. You could walk into a big bank and hope their one-size-fits-all loan works for you. Or you could work with a mortgage broker, like the Homeseed Lending Team, who has the tools and flexibility to shop for you. At Homeseed Lending Team, we believe the broker model gives clients the biggest advantage. Here's why working with us can save you time, money, and stress.

Published on 04/23/2025

2025 Spring Mortgage Update: Tariffs, Rates, and Market Strategy

Mortgage rates trended lower throughout most of Q1 2025, but new tariffs have introduced volatility over the past week. Still, forecasts point to lower rates later this year. With housing inventory rising compared to previous years, the spring market presents real opportunities if you’re prepared. Here's what you need to know.

Published on 04/10/2025

How Trump’s Tariff Plans Could Impact Mortgage Rates and the Housing Market

This week, President Trump laid out plans for sweeping new tariffs on a broad range of imported goods, targeting everything from autos and groceries to construction materials.

Published on 04/03/2025

Seasonal Buying Opportunity & Fed Updates

As we head into spring, homebuyers are facing a unique window of opportunity fueled by seasonal trends, update from the Fed, and shifting mortgage rates. If you're planning to make a move in 2025, understanding what’s happening in the market right now can help you make a smart, strategic decision. Let’s break it down below.

Published on 03/20/2025

Cash is King: Secure Your Next Home With A Cash Offer

In today’s housing market, multiple offers and bidding wars are common—especially for well-priced homes in desirable neighborhoods. That’s why sellers prefer cash offers because they speed up closing, minimize contingencies, and reduce risk.

Published on 03/05/2025

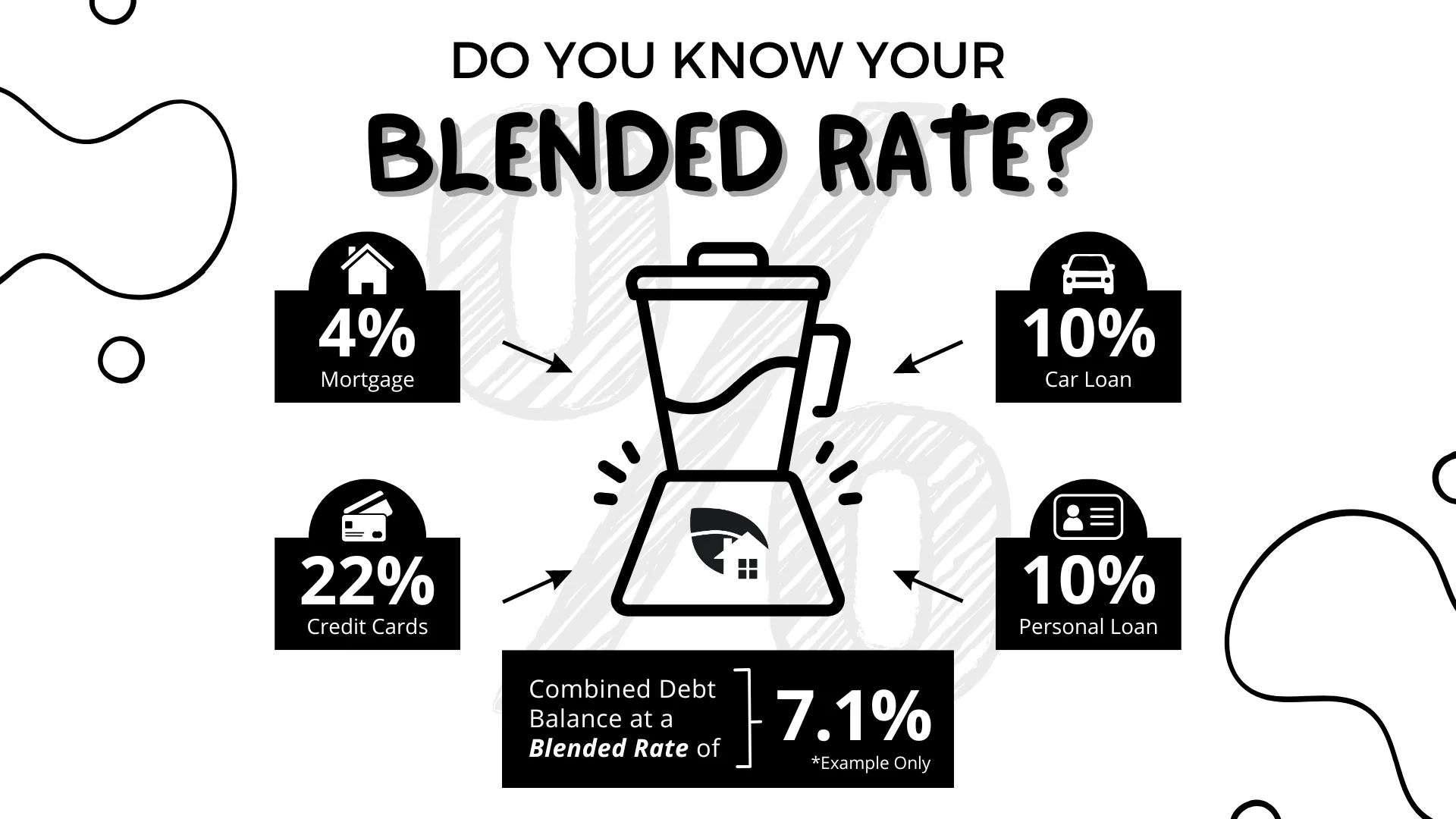

How to Access Your Home Equity and Consolidate High-Interest Debt

Homeowners have options to access their home's equity to pay off high-interest debt, potentially saving thousands in interest and improving monthly cash flow.

Published on 02/19/2025

Buy Now, Sell Later – Consider Bridge Loan Financing for a Smoother Move

Buying a new home before selling your current one can be a challenge, especially in a competitive market. Bridge loans provide a solution, allowing you to make a strong offer without a home sale contingency. Here’s a look at three bridge loan options that can help you buy now and sell later with confidence.

Published on 02/05/2025

2025 Housing & Mortgage Outlook: Lower Rates + Promising Opportunities

As we step into 2025, the mortgage and real estate markets continue to evolve, influenced by economic trends and shifting dynamics. Here's a look at the key areas shaping the landscape this year.

Published on 01/17/2025