How to Access Your Home Equity and Consolidate High-Interest Debt

If you're like many Americans, you may be feeling the pinch of high interest debt. According to a recent report from the New York Federal Reserve, household debt soared to $18.04 trillion in the fourth quarter of 2024, an all-time high. With average credit card interest rates rising above 20% and auto loans near 10%, this debt can quickly become overwhelming. The good news? Your home may hold the key to improving your financial situation.

Tap into Your Home Equity to Free Up Monthly Cash Flow

Homeowners have options to access their home's equity to pay off high-interest debt, potentially saving thousands in interest and improving monthly cash flow. Two of the most popular ways to do this are through a cash-out refinance or a home equity line of credit (HELOC).

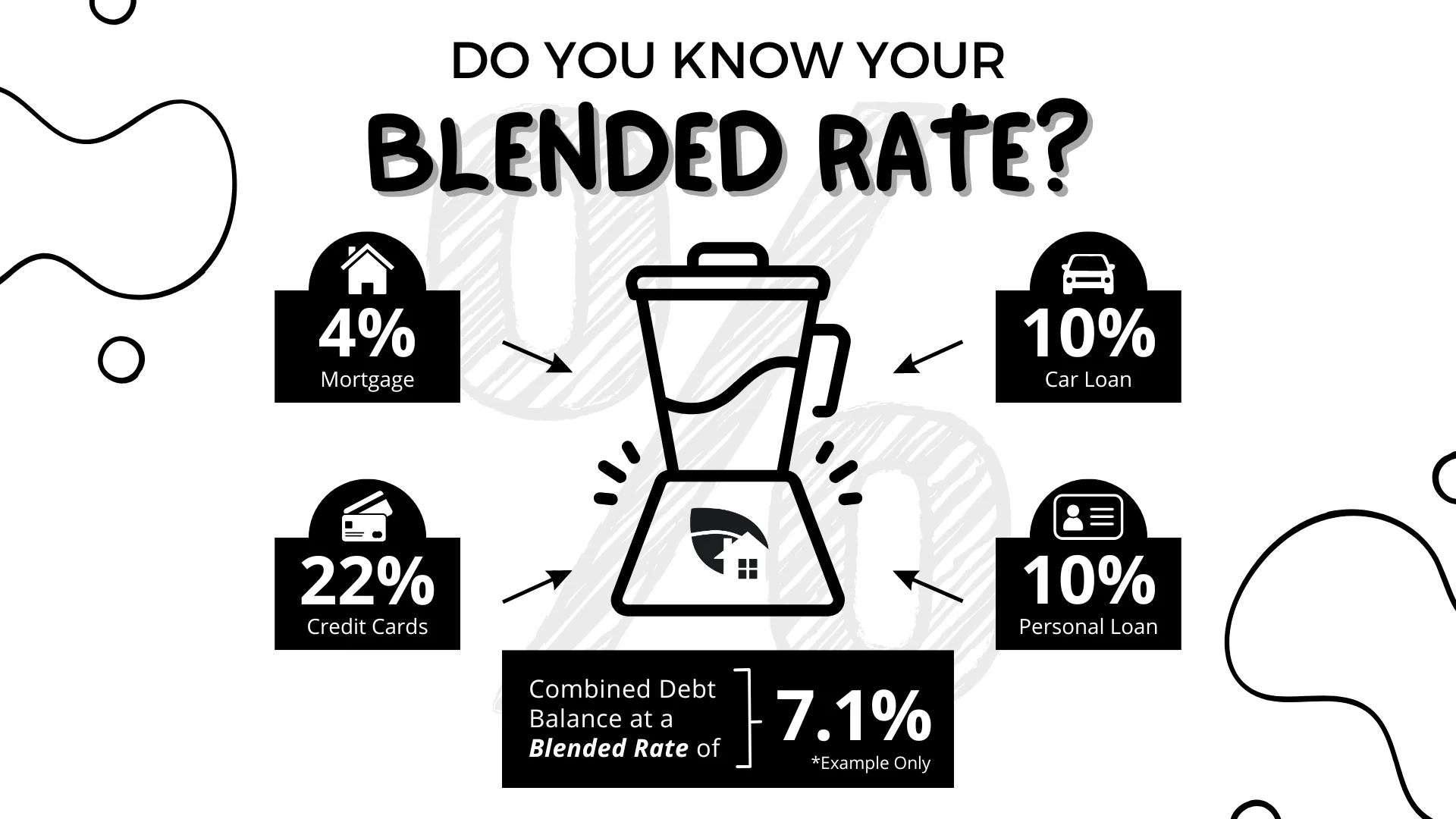

Understanding the "Blended Rate" Concept

Some homeowners hesitate to refinance if they have a low-interest rate on their current mortgage. However, when you factor in the higher interest rates and payments of other debts (like credit cards and auto loans), your overall blended rate could be higher than you think.

Blended Rate Example:

Let’s say you have:

While your mortgage rate is low, the high-interest debts significantly raise your total monthly payments. Consolidating these debts through a cash-out refinance at, say, 7% could lower your overall payments, even with a higher mortgage rate.

Before Refinancing:

After Consolidating Debt (Cash-Out Refinance at 7%):

That’s an extra $1,136 in your pocket every month, not to mention simplifying your finances with just one monthly payment. Redirecting these savings back into additional payments on your mortgage could potentially help you save thousands in interest as well.

Is Accessing Your Home Equity Right for You?

Every homeowner's situation is unique. While a cash-out refinance or HELOC can be a powerful tool for debt consolidation, it's important to weigh the pros and cons. Consider how long you plan to stay in your home, the costs of refinancing, and your long-term financial goals.

Our Homeseed Lending Team is here to help you navigate your options. We’ll review your financial situation, provide a blended rate analysis, and determine if tapping into your home equity can help you save money and reduce stress.

The information provided is for educational purposes only and does not constitute financial advice. Please consult with a financial advisor to assess your specific situation.

Loan Originator

Barrett Financial Group, L.L.C. | NMLS: 1786259