How Trump’s Tariff Plans Could Impact Mortgage Rates and the Housing Market

This week, President Trump laid out plans for sweeping new tariffs on a broad range of imported goods, targeting everything from autos and groceries to construction materials. While the political debate continues, these proposals are already stirring economic concerns, and those concerns are playing out in the financial markets. Interestingly, those reactions could carry a silver lining for homebuyers and homeowners, potentially creating new opportunities in the mortgage and housing markets.

Tariffs Spark Market Jitters

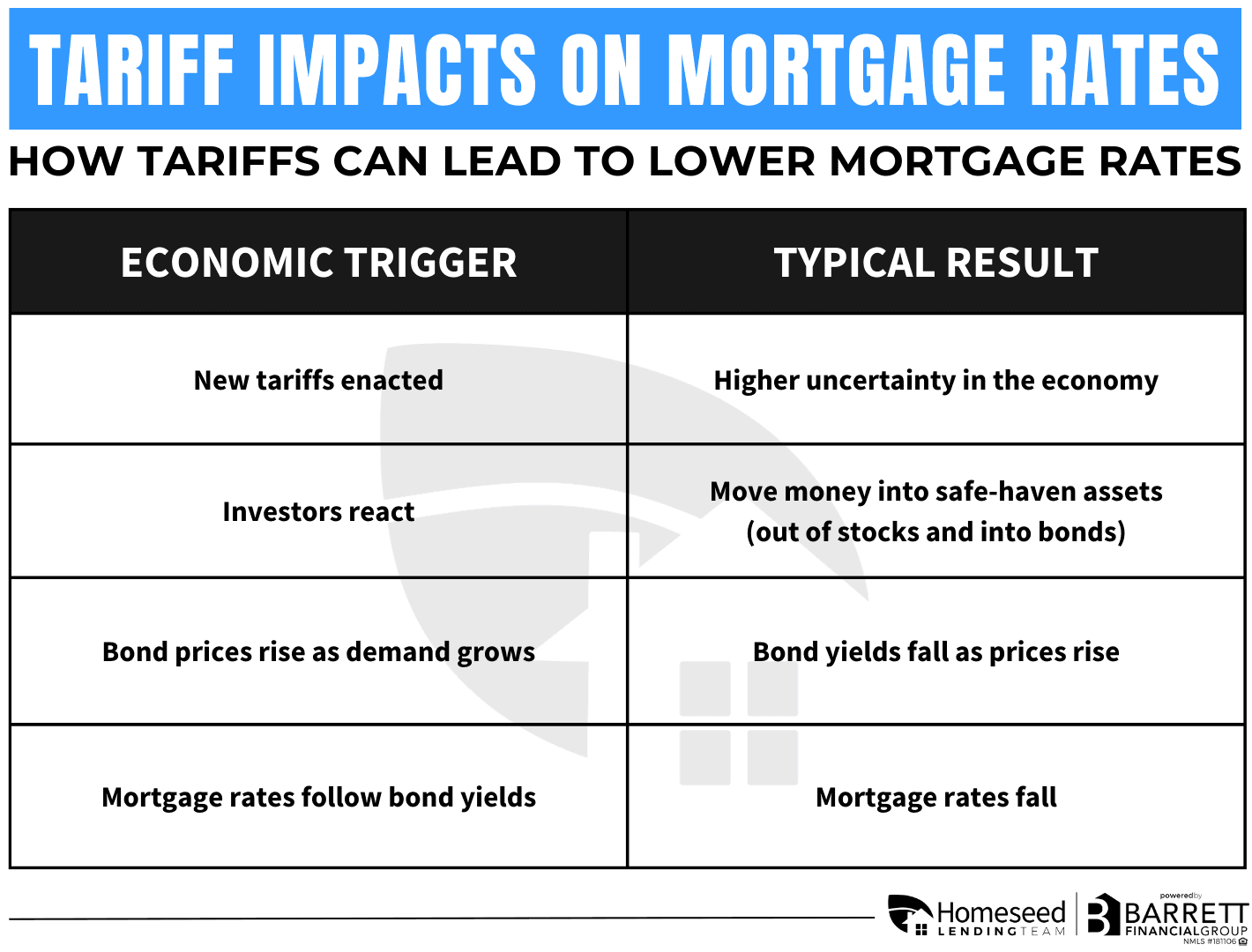

Tariffs tend to raise the price of imported goods, which can lead to slower consumer spending, higher costs for businesses, and strained trade relationships with global partners. In short, they introduce uncertainty, and markets don’t like uncertainty.

Investor Flight to Safety

When economic outlooks turn shaky, investors typically shift their money out of riskier assets like stocks and into safe-haven assets like U.S. Treasury bonds. This “flight to safety” boosts demand for bonds, which drives up prices and causes yields to fall. That is exactly what we have seen in recent weeks, and especially today, with both stocks and bond yields dropping noticeably, signaling investor concern and pushing mortgage rates down along with them.

Falling Yields = Falling Mortgage Rates

Mortgage rates closely follow the 10-year Treasury yield. As yields decline, so do mortgage rates. This is one of the reasons rates have been trending lower lately, despite inflation still being a concern. The uncertainty surrounding new tariffs has added fuel to the bond rally, creating a window of opportunity for homebuyers and homeowners alike.

A Potential Recession

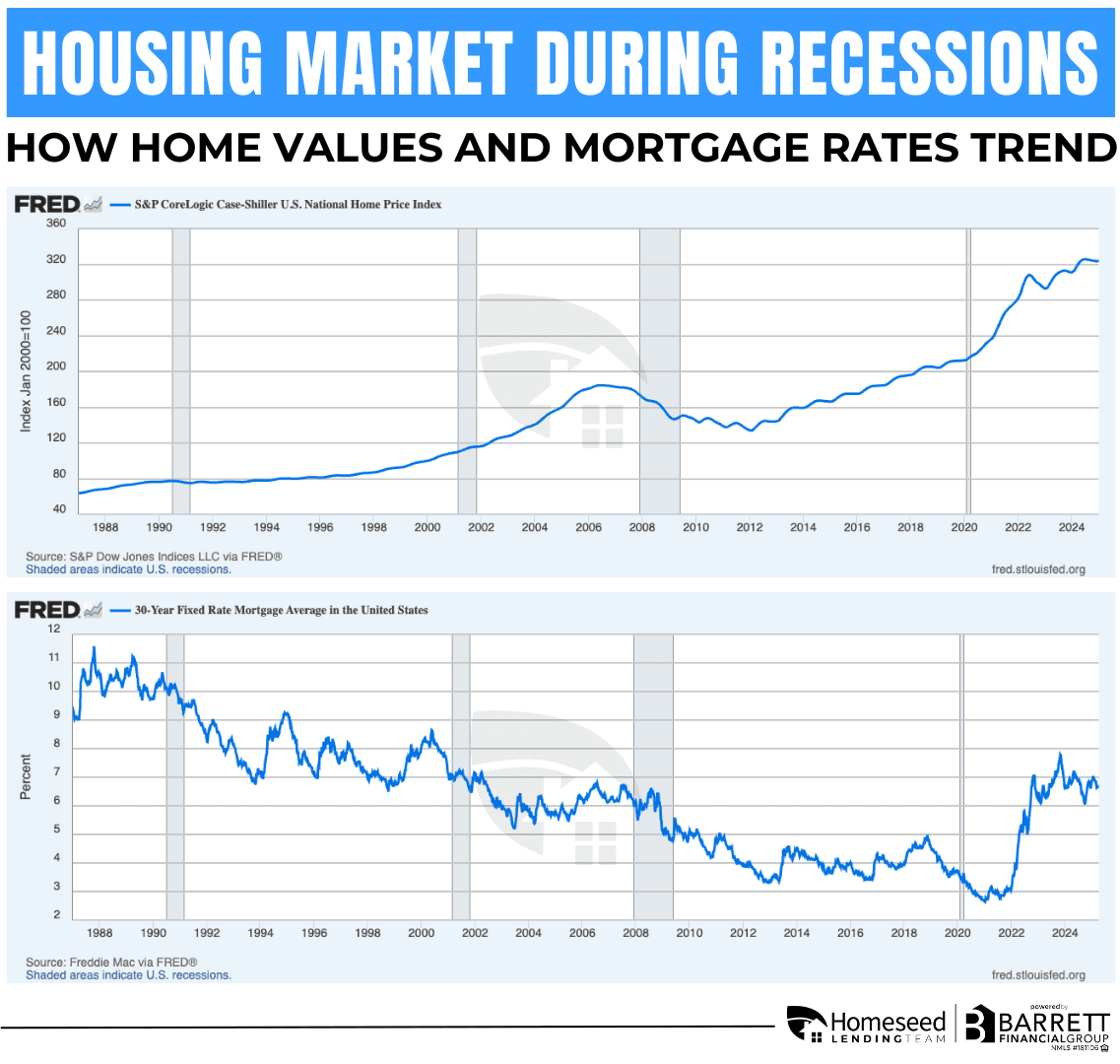

All this uncertainty has spurred talk of a possible recession. Historically, when recessions hit, the Federal Reserve has responded by cutting interest rates further to stimulate the economy as most recently seen during the COVID-19 pandemic. Lower Fed rates typically lead to lower mortgage rates, and in many past recessions, housing has remained relatively strong.

While job losses can occur during economic downturns, lower interest rates often make homeownership more affordable for a broader pool of buyers. In fact, more people tend to become eligible for mortgages during these rate drops than those who lose homebuying ability due to job insecurity.

What This Means for You

If you're in the market to buy a home or refinance, now may be a great time to lock in a favorable rate before volatility returns. Even amid uncertainty, market shifts like these can open up powerful opportunities. For homeowners, this could also be a smart time to consider setting up a home equity line of credit (HELOC). Accessing available equity now can provide flexibility to cover future expenses or unexpected needs down the road.

Let’s talk about how today’s market conditions can work in your favor.

Loan Advisor

Barrett Financial Group, L.L.C. | NMLS: 966624