2025 Spring Mortgage Update: Tariffs, Rates, and Market Strategy

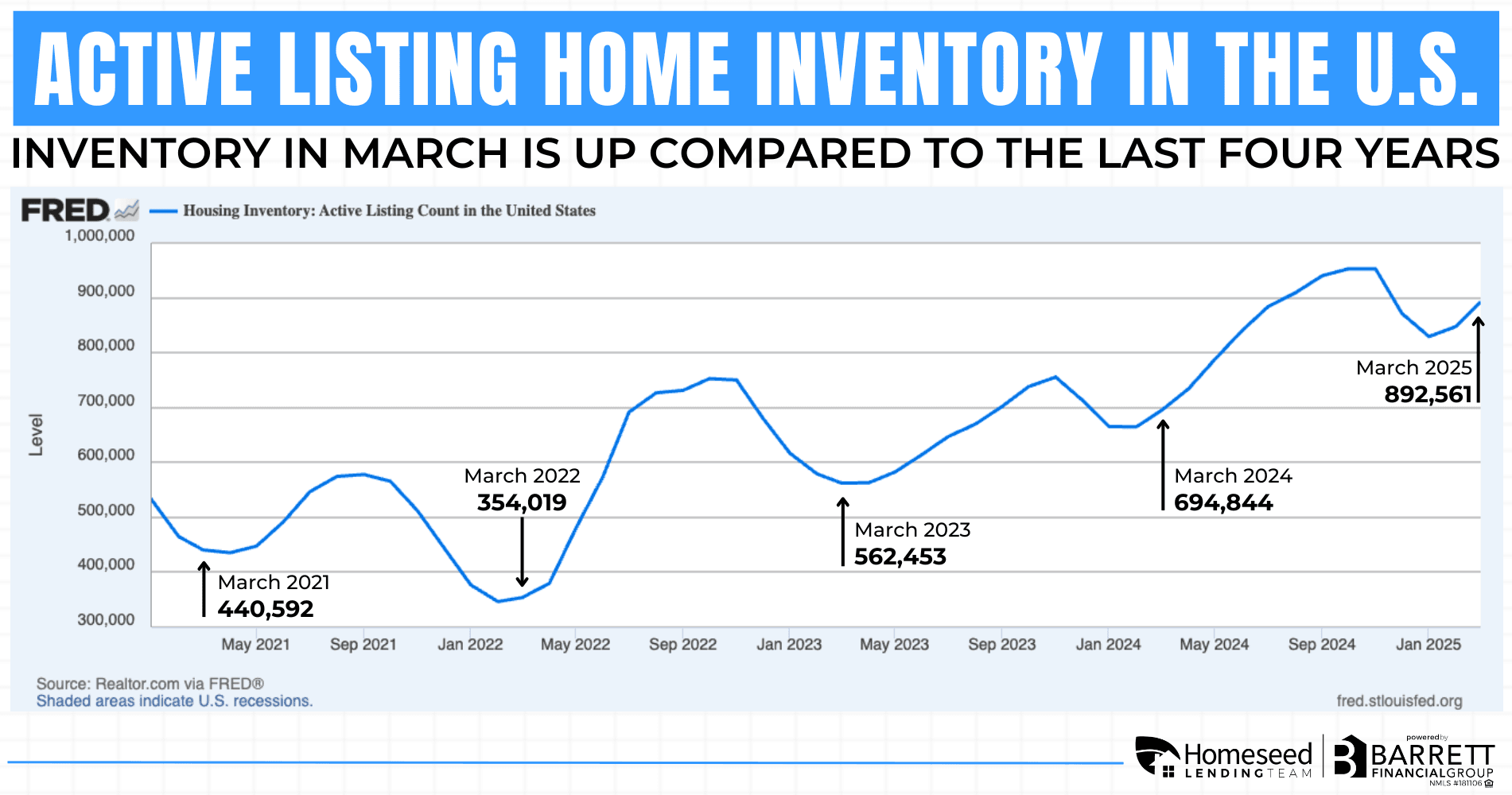

Mortgage rates trended lower throughout most of Q1 2025, but new tariffs have introduced volatility over the past week. Still, forecasts point to lower rates later this year. With housing inventory rising compared to previous years, the spring market presents real opportunities if you’re prepared. Here's what you need to know.

What’s Causing All This Market Volatility?

- Recent U.S. tariffs announced by President Trump have created global economic uncertainty.

- Investors have been rapidly moving money in and out of the bond market in response.

- Since mortgage rates closely follow bond markets, this has caused rates to swing sharply.

- While the headlines may seem concerning, it’s normal for mortgage rates to fluctuate significantly in response to major policy changes, especially in the short term.

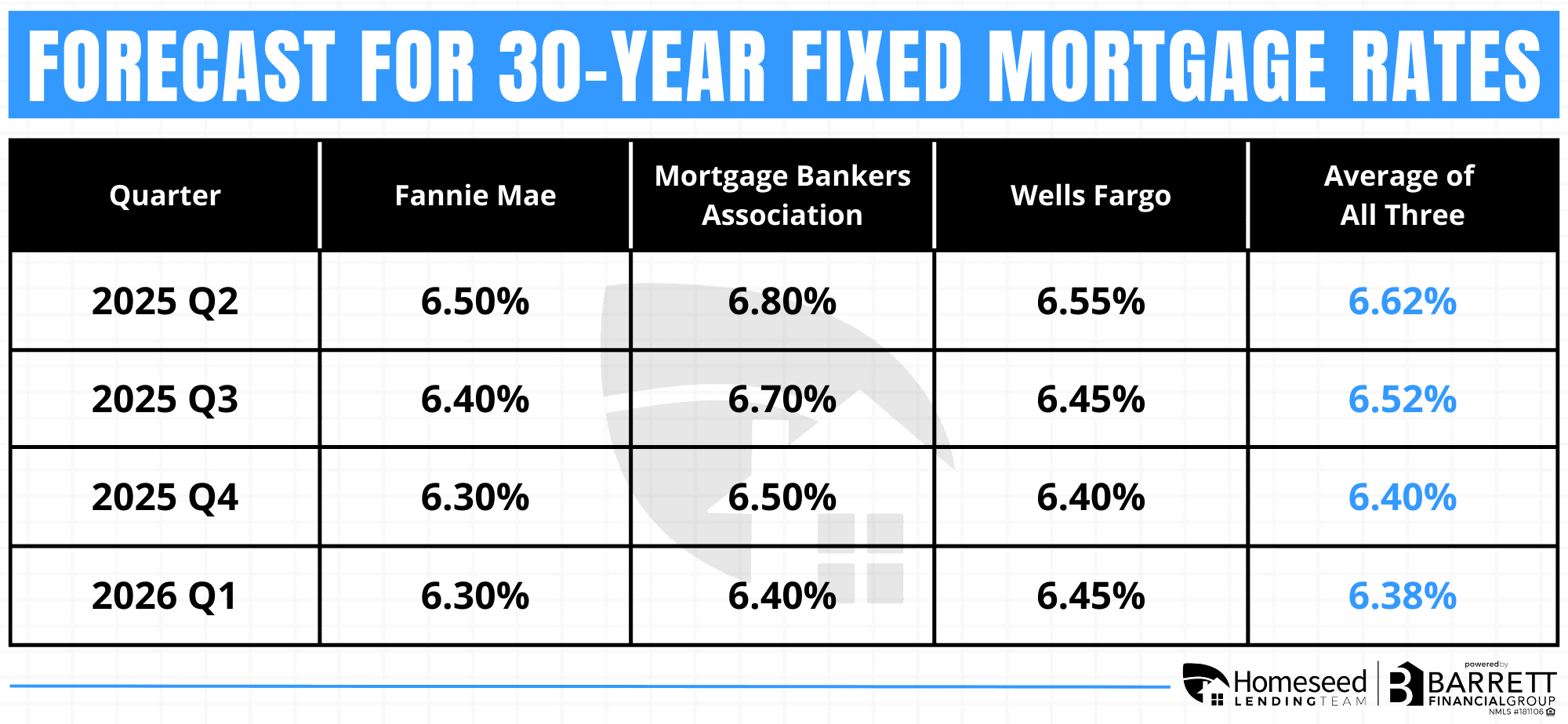

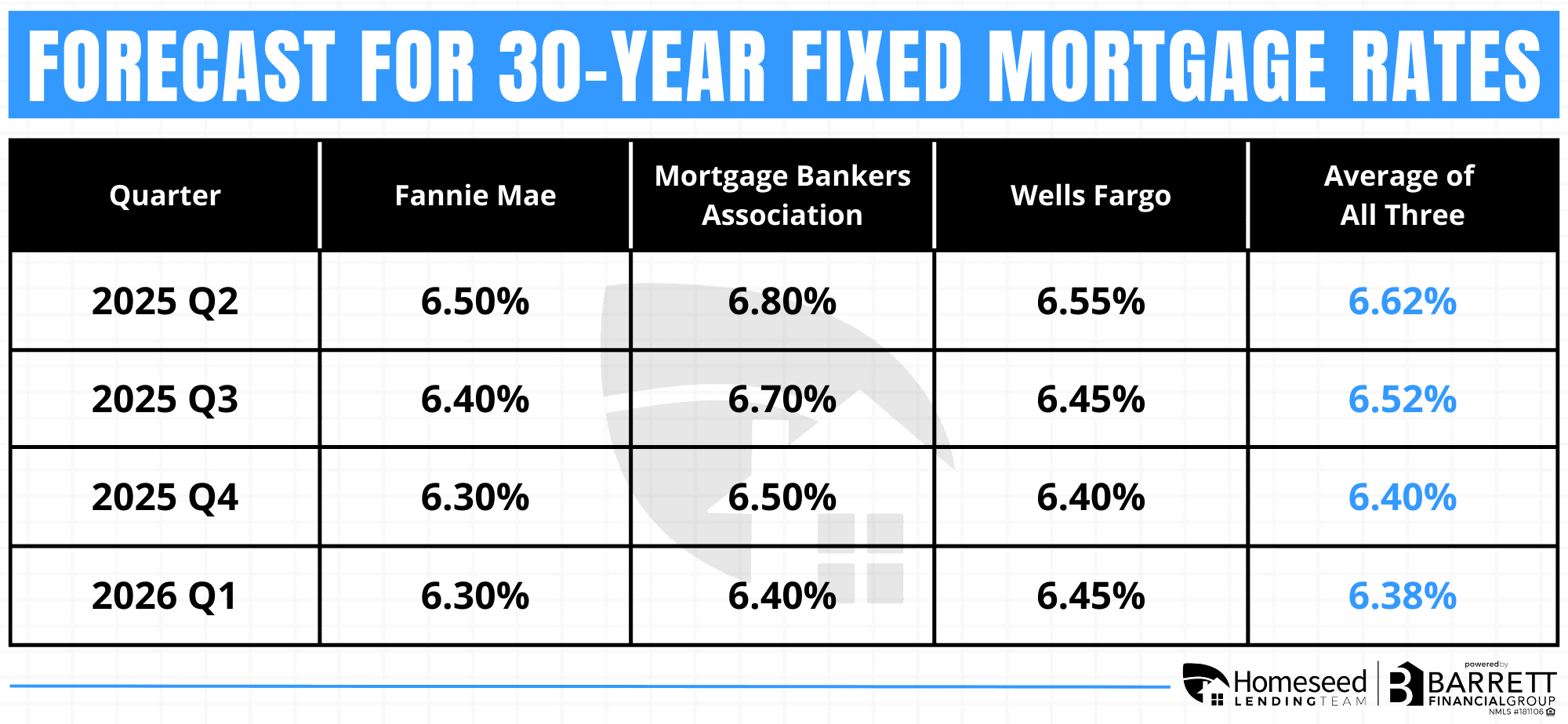

Mortgage Rates: Volatile Now, But Still Forecasted to Fall

- Despite the recent volatility, many industry forecasts still expect rates to trend lower by the end of the year.

- If you’re thinking about purchasing, make sure we have an updated pre-approval as the most successful buyers are making confident moves based on a solid plan.

- If you're thinking about refinancing, it's a good idea to define your target "strike rate" and stay in touch so we can help you lock in quickly when the market improves.

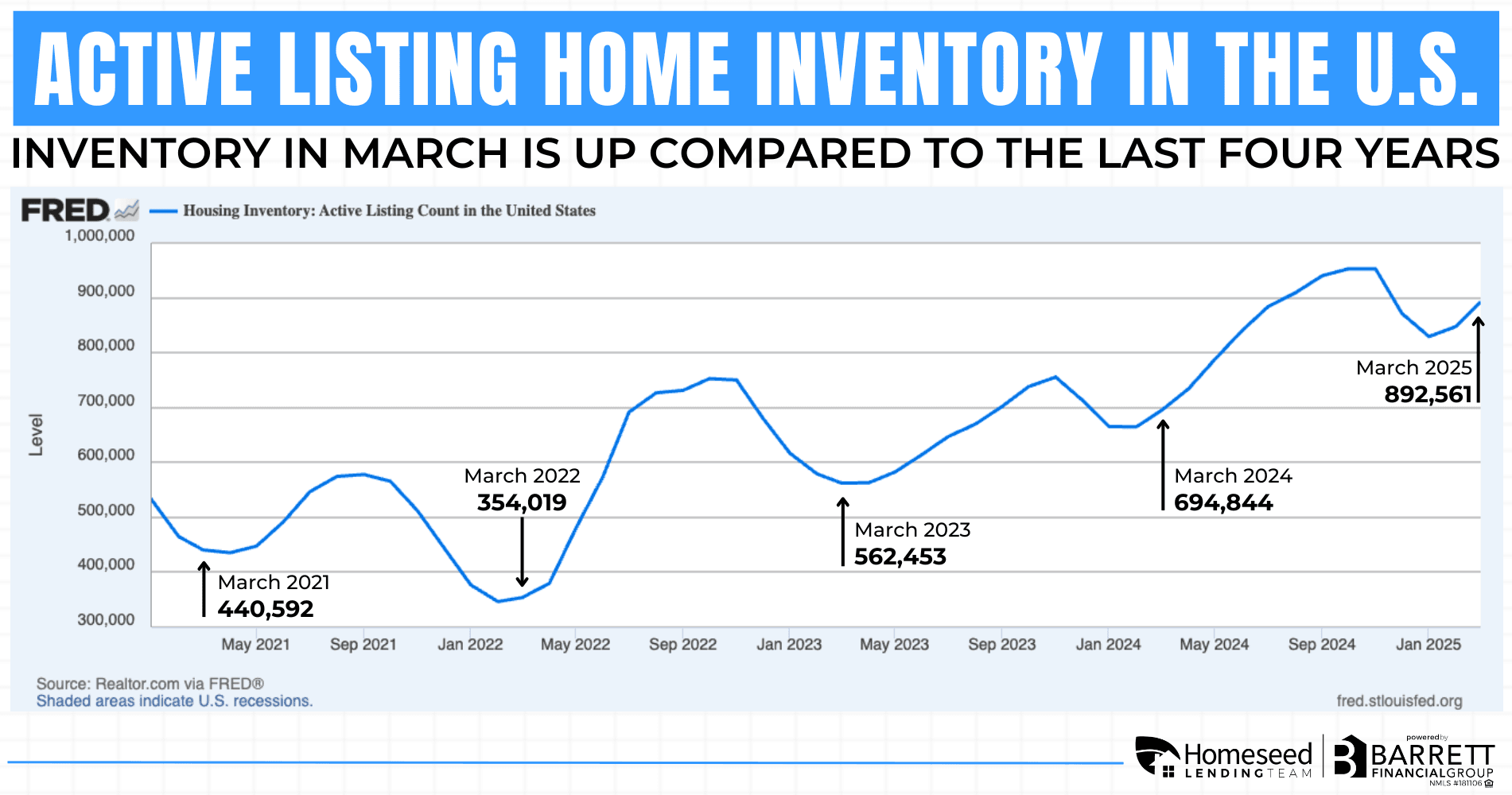

Spring Market: A Season Full of Opportunity

- Inventory is higher than in previous years as we enter the busiest season for real estate.

- More listings mean more choices for buyers, making now a smart time to act before competition intensifies.

- For homeowners, strong buyer demand continues to support rising home prices and creates opportunities to tap into equity.

- Historically, home values have risen even during uncertain times, where prices have actually increased in 6 of the last 7 recessions.

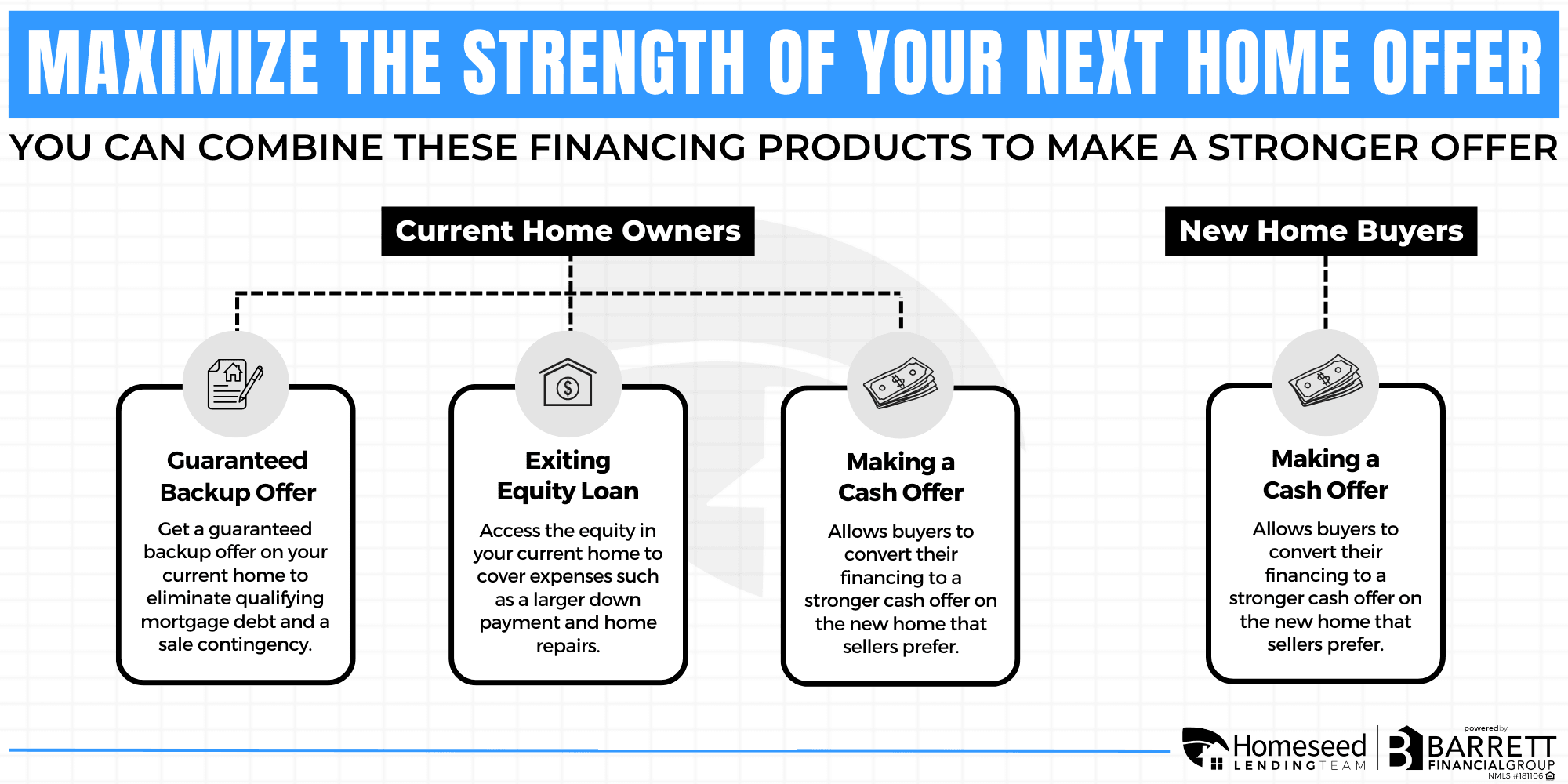

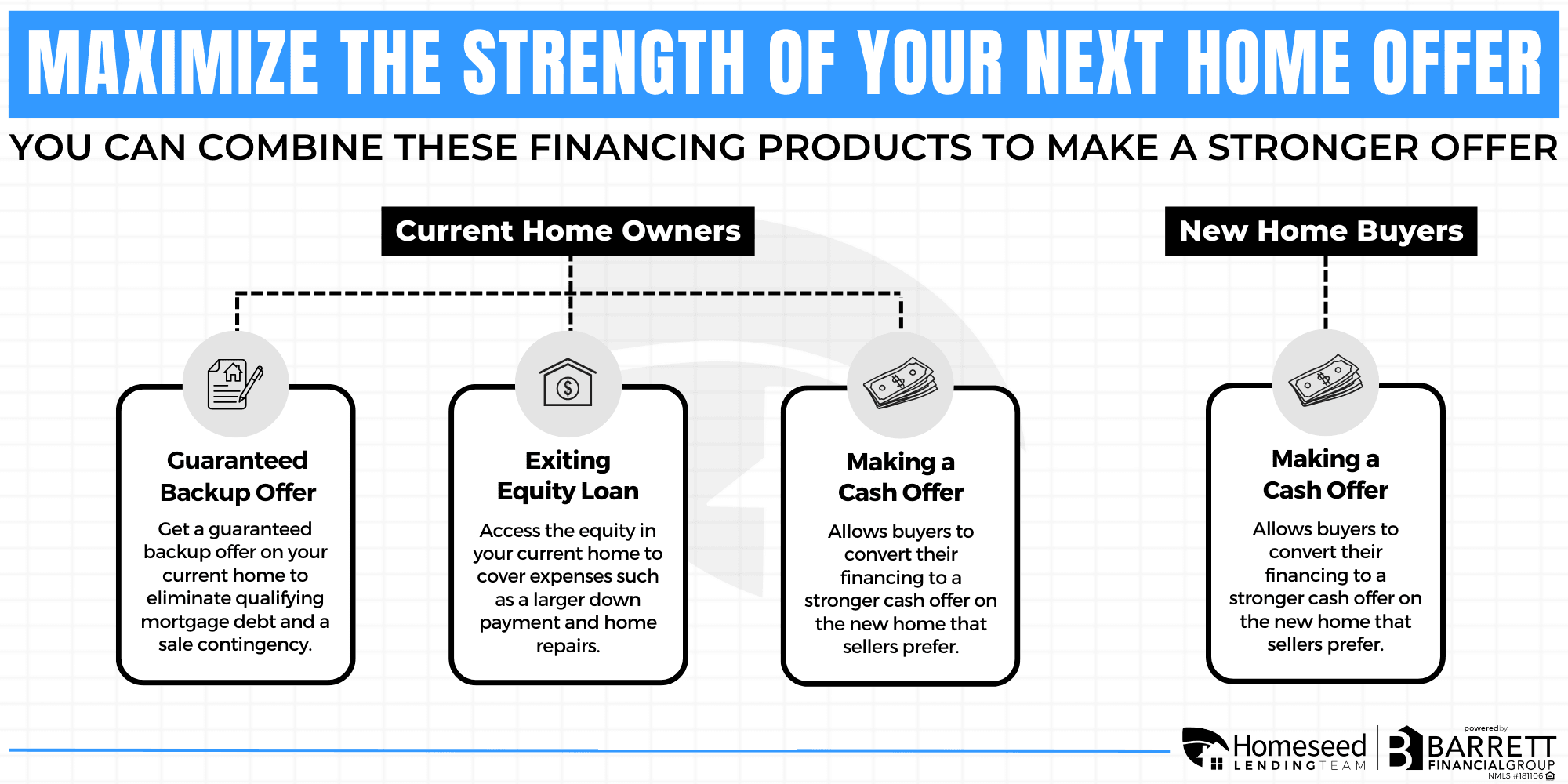

Win in Today’s Market With a Strategy

- In a competitive market, how you make your offer can make all the difference.

- We offer specialized loan programs that give you an edge, such as:

- Buy Before You Sell: Purchase your next home without waiting to sell your current one or making a contingent offer.

- Cash Offer Programs: Compete with cash buyers by making a cash-equivalent offer while still using financing.

- These tools can help you stand out and close faster, even in multiple-offer situations.

Let’s Talk Strategy

- If you’re even thinking about buying, selling, or refinancing this year, now is the time to get a plan in place.

- We’ll help you track rates, get you pre-approved, and guide you through your options.

- Don’t wait for the perfect timing as opportunities come to those who are prepared and ready.